From the invention of the credit card all the way to the roller coaster of crypto-currencies, we’ve been looking for a way to replace cash for a long time now. Mobile e-commerce has emerged in this conversation as a likely contender.

The modern consumer doesn’t want to go somewhere his card can be swiped. Staying at home and opening up websites is a relic of history. We want to buy anything from anywhere, at any time. And we can.

The last time we experienced a shift of this magnitude in the financial world was with the discovery of e-commerce itself. The ability to buy anything from your computer felt revolutionary at the time, but desktop computers lost the battle to laptops pretty quickly. Today, we do most of our shopping on the phone. That’s mobile e-commerce, or M-Commerce, and it’s taking over.

The Statistics of Mobile E-Commerce

When a trend sees sustained growth over ten years, it’s worth paying attention to it. M-commerce sales have been seeing double-digit growth for years now and are close to 8% of total retail sales made in the U.S. YCharts.com will tell you that total e-commerce sales make up just under 16% of retail sales. It becomes clear that m-commerce is slowly but steadily eating up the market for virtual finance.

Image: eMarketer, 2022

This statistic is more significant than what initially meets the eye. It’s common knowledge that the world is becoming increasingly digital, and the methods we use to access the digital world are evolving. Smartphone users are rising exponentially all over the world, especially compared to desktops.

Phones are individual devices, so everybody in the home will probably have one, as opposed to the family computer of 15 years ago. They’re also much easier to use because of how portable they are; they’re literally designed for you to be able to use them anywhere. The already miniscule amount of time we spend on computers is falling even further as a percentage of our total time spent online.

Image: eMarketer, 2022

These are stats just for the U.S., but the world shows a similar picture on aggregate. It shouldn’t surprise anybody that China leads the world when it comes to using mobile phones as a payment method. Worldpay estimates that digital transactions make up 49 percent of transactions worldwide. However, China is close to 90%.

The Asian tech giants have dictated global trends in the past, and this isn’t any different. Most countries in the world have seen an uptick in mobile transactions and the market is predicted to balloon up to $350 billion by 2024. As citizens of third-world countries get access to the internet and mobile phones, a huge new market will explode. India is already competing with world leaders in mobile transactions.

Global Adoption of mobile/digital payment (2019-2021)

Image: E-Marketer

Reasons for the Growth of Mobile E-Commerce

Shifting to digital commerce has benefits for both buyers and sellers (discussed below). However, there have been cultural shifts in the past few years that have contributed to this growth.

The COVID-19 lockdown forced most transactions to become contactless, but lifting the lockdown didn’t bring the trend to a halt. Regular transactions resumed, but consumers held on to the convenience of contactless payment. Companies, and in turn the entire economy, got incentives from this demand to innovate and perfect mobile e-commerce transactions.

It turns out that the integration of different apps on a mobile phone is much better for building consumer profiles than a website. This meant more funding for research and development to iron out the kinks for mobile transactions. This quest started bringing fruition when businesses could rely on AI for precise, consistent help with management that would be too expensive to do with humans.

Once our computation abilities improved to where they are today, we recognized the huge potential of having people online. Exploiting impulse buying by making it super convenient to buy immediately, tracking consumer behavior, and the abilities of mass marketing using machine learning are just a few of the gates that open up with mobile e-commerce. One of the biggest indications of a field becoming successful and staying successful is that tech giants are buying into it.

The Big Players in Mobile E-Commerce

Google Pay

Android phones hold the biggest share of mobile users across the world, and Google Pay comes pre-installed on every single one of them. The app enables contactless payment at in-person stores and mobile payment from anywhere. The sheer dominance of Google in the global market for all things digital makes it a major shareholder in every market it enters. Their entry also shows an extreme amount of confidence in the future of m-commerce.

Apple Pay

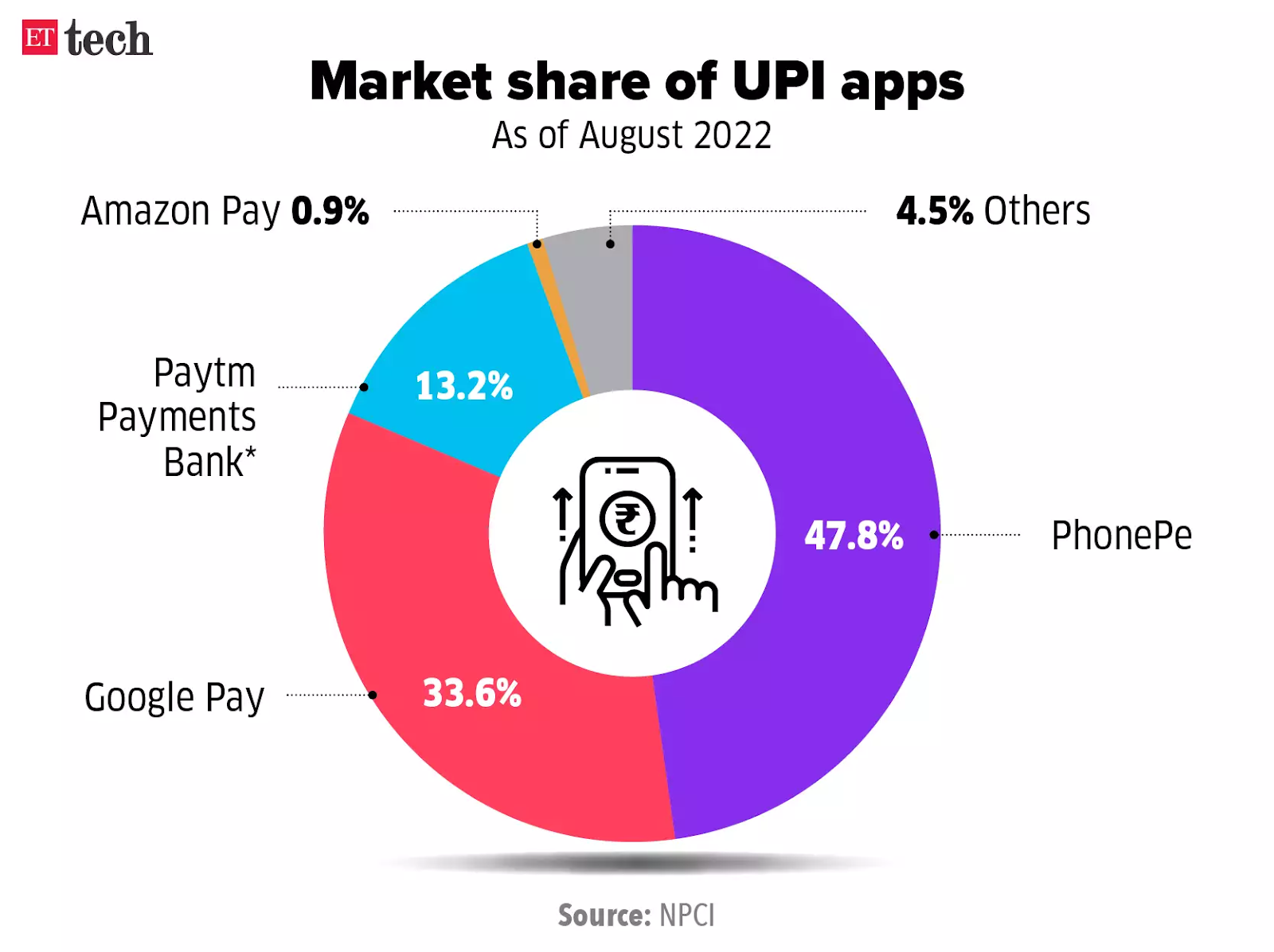

Although they don’t show up very high in the market share of UPI (Unified Payment Interface) apps, Apple Pay is a leader in the mobile-wallet space. There are over 50 million Apple Pay users in the United States, which is around 90% of the entire mobile wallet market. When a mobile wallet works in 76 countries and processes 6 trillion dollars in transactions, it’s worth mentioning..

Amazon Pay

Amazon is one of the only companies in the world that can take on Google, Apple, and Facebook in the digital world, and it’s been doing a pretty good job. It’s only natural that the company would offer mobile payment options of its own when they’re the biggest online marketplace in the world. They’ve had an aggressive expansion strategy all over the world, and their size lets them bring all services in-house. They have their own delivery trucks now, so you can bet they want a share of the M-Commerce pie

PhonePe

It’s fitting that the only company that doesn’t come from the U.S. is from Asia, but the Chinese lost to the Indians on this one. India has prioritized developing local brands in the mobile industry, the car industry, and the space industry, and M-Commerce is no different. PhonePe holds the largest market share in the world for unified payment interfaces.

The Advantages of Mobile E-commerce

For Customers:

Multiple Payment Options

Making a service convenient is the most important step towards making it a household item. Cash went out of fashion for this very reason: people don’t want to carry it around. Credit cards have their own set of complications, but mobile payment isn’t for everybody either. What it offers is another option for payment.

This option is even more important for online shopping and, as we discussed, that’s the future of retail in the first place. There are sellers on social media apps, in-app purchases, websites for large and small businesses, and the app store itself. There are hundreds of places to spend your money at any moment on your phone, and mobile e-commerce gives you ways to spend that money.

Improved Security

Assuring people they’re money won’t disappear into thin air or their virtual wallet won’t be hacked was one of the biggest hurdles for the market. We’ve been improving security using blockchain technology to overcome the threats of credit card theft and money laundering, but there are cheaper and more accessible options.

Mobile phones have become extremely proficient with biometric technology for facial recognition, voice commands, and fingerprint recognition. Even for phones that don’t have that technology (which is rare), there are 2-factor authentication protocols that are easy to set up. Immediate notifications for transactions and caps for the amounts of money that can be spent in a single transaction are just some of the other measures mobile wallets use to ensure the safety of their users.

For Shopkeepers:

Capturing Omni-Channel shoppers

Remember what we talked about when it comes to spending money on different apps on your phone? Add the use of mobile wallets to pay at in-person stores and you have omni-channel commerce. The concept revolves around having a single framework from which you can pay for everything, everywhere.

Companies want to have a presence on all channels so they can capture the growing number of omni-channel shoppers. The majority of these shoppers come from millennials and younger generations, who are extremely likely to trust brands that have an online presence. Companies are forced to be on social media with cohesive brand messages to maximize the likelihood of converting customers. When they do, they need to give them a way to pay, and mobile e-commerce is the best option for them to provide a seamless shopping experience.

Collecting Data

Market analysis has completely evolved with the use of AI. We can recognize trends from billions of data points and use them to predict user behavior. The more data we can feed our AI, the better its analysis will be, and the more we will be able to profit. Even the smallest of businesses have access to powerful AI through GA4 and the Google Search Console that they can use to grow their business.

Mobile e-commerce is such a powerful tool because it maximizes the amount of data corporations can collect. Even concerns about privacy and consequent regulations limiting the amount of data that can be collected haven’t stopped the movement. Rather than finding an alternate method, introducing zero-party data is much easier. It refers to data that is collected voluntarily in exchange for personalized recommendations.

A certain percentage may opt to not have their data collected, but it’s unlikely everybody will start reading the terms and conditions. Despite whistleblowers and scandals, the market is still moving towards virtual finance. The bottom line is that the economy is structured in a way that makes M-Commerce the most convenient transaction method for the future. If trends are any indication, that convenience may outweigh any concerns about obstacles that may arise, and we’ll improve security measures over time. Between the ease it gives customers and the profit it makes for corporations, M-commerce is the solution.

Looking to boost your sales with mobile e-commerce? We are here to help. Contact us today!